SUVs are powerful, spacious, and built for all kinds of roads. Whether you drive in the city, on highways, or off-road, an SUV gives you comfort and confidence. But owning an SUV also means higher responsibility—and that’s where SUV insurance becomes very important.

Many SUV owners buy insurance just to follow the law. But the truth is, SUVs need stronger and smarter insurance than regular cars. In this article, we’ll explain SUV insurance in very simple words—what it is, why it matters, the best types of coverage, and common mistakes to avoid.

Why SUV Insurance Is Important

SUVs are usually bigger, heavier, and more expensive than hatchbacks or sedans. Because of this:

- Repair costs are higher

- Spare parts are costly

- Damage impact can be bigger

- Theft risk is often higher

That’s why SUV insurance is not just a legal requirement—it’s financial protection. A good SUV insurance policy saves you from sudden heavy expenses after accidents, theft, or natural disasters.

What Is SUV Insurance?

SUV insurance is a car insurance policy designed to cover Sports Utility Vehicles. It protects your SUV against:

- Accidents

- Theft

- Fire

- Natural disasters (flood, storm, earthquake)

- Man-made damages (riots, vandalism)

SUV insurance also covers third-party liability, which is mandatory by law in many countries.

Types of SUV Insurance

Understanding the types of SUV insurance helps you choose the right one.

1. Third-Party SUV Insurance

This is the most basic form of SUV insurance and is legally required.

It covers:

- Injury or death of a third person

- Damage to someone else’s vehicle or property

What it does NOT cover:

- Damage to your own SUV

- Theft of your SUV

Third-party SUV insurance is cheap, but it offers very limited protection.

2. Comprehensive SUV Insurance

This is the most recommended SUV insurance.

It covers:

- Third-party liability

- Damage to your SUV

- Theft

- Fire

- Natural disasters

If you own a new or expensive SUV, comprehensive SUV insurance is the best choice.

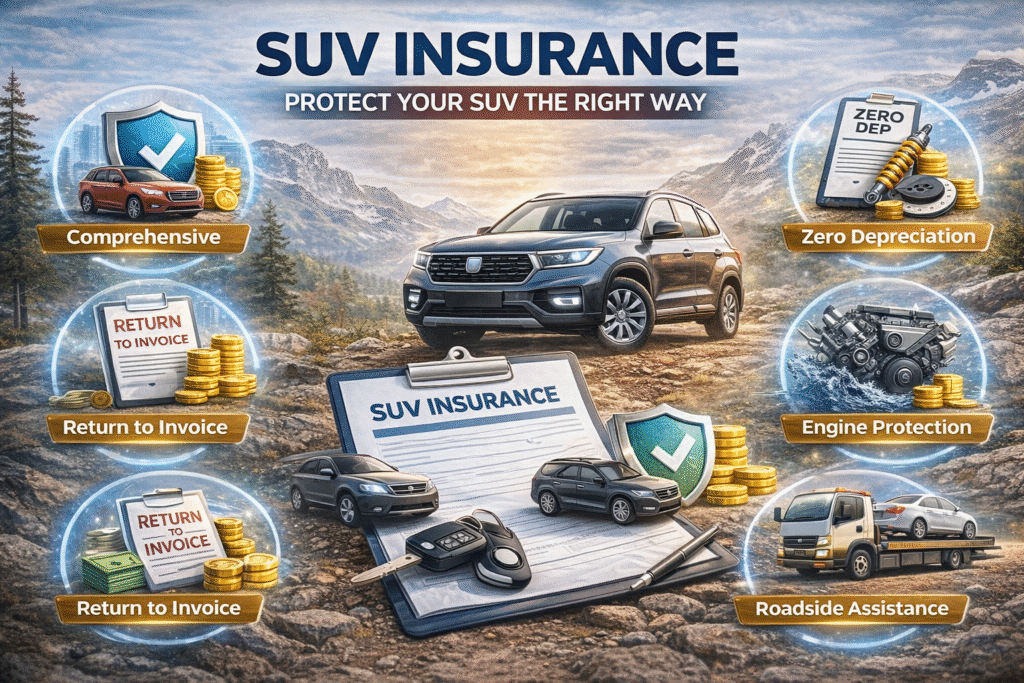

Best Add-Ons for SUV Insurance

SUVs often travel long distances and rough roads. Add-ons make SUV insurance stronger and more useful.

1. Zero Depreciation Cover

SUV parts are expensive. With normal insurance, depreciation is deducted during claims.

Zero depreciation SUV insurance:

- Covers full cost of parts

- Gives higher claim value

- Is best for new and premium SUVs

2. Engine Protection Cover

SUVs are often driven in water-logged roads or rough terrain.

Engine protection SUV insurance covers:

- Water damage

- Oil leakage

- Engine failure due to floods

This add-on is very useful in rainy or flood-prone areas.

3. Roadside Assistance Cover

SUVs are built for travel, but breakdowns can happen anywhere.

Roadside assistance SUV insurance provides:

- Towing

- Flat tire help

- Battery jump-start

- Emergency fuel

This is a must-have add-on for frequent travelers.

4. Return to Invoice Cover

If your SUV is stolen or totally damaged, return to invoice SUV insurance pays:

- Original invoice value

- Registration charges

- Road tax

This add-on is best for new SUVs.

5. Consumables Cover

SUV repairs include consumables like:

- Engine oil

- Coolant

- Brake fluid

Consumables cover SUV insurance pays for these items during repairs.

How to Choose the Right SUV Insurance

Choosing the right SUV insurance is simple if you follow these steps:

✔ Know Your SUV’s Value

Expensive SUVs need higher coverage and better add-ons.

✔ Choose Comprehensive Coverage

Avoid basic policies if your SUV is valuable.

✔ Select Useful Add-Ons

Pick add-ons based on how and where you drive.

✔ Compare Insurers

Compare premium, coverage, claim service, and reviews.

✔ Check Claim Settlement Support

Good claim service is more important than low premium.

Cost of SUV Insurance

SUV insurance usually costs more than small cars because:

- SUVs are bigger

- Repair costs are higher

- Engine capacity is larger

The price of SUV insurance depends on:

- SUV model and variant

- Engine size

- City of registration

- Add-ons chosen

- Driver history

While SUV insurance may seem expensive, it saves much more during claims.

Common Mistakes SUV Owners Make

Avoid these mistakes while buying SUV insurance:

- Choosing the cheapest policy only

- Ignoring add-ons

- Setting very low IDV

- Not reading policy terms

- Delaying renewal

A small mistake in SUV insurance can lead to big losses later.

SUV Insurance for New vs Old SUVs

New SUV Insurance

- Choose comprehensive coverage

- Add zero depreciation and return to invoice

- Keep IDV close to invoice value

Old SUV Insurance

- Review add-ons carefully

- Engine protection is important

- Balance premium and coverage

SUV Insurance for Off-Road and Adventure Driving

If you use your SUV for:

- Long road trips

- Hills or deserts

- Off-road driving

You should inform your insurer and choose:

- Strong engine protection

- Higher coverage limits

- Roadside assistance

Normal SUV insurance may not cover damages from extreme usage unless declared.

Why SUV Insurance Renewal Matters

Never let your SUV insurance expire.

Late renewal can cause:

- Higher premium

- Loss of No Claim Bonus

- Inspection delays

- Legal penalties

Always renew SUV insurance before expiry to stay protected.

Benefits of Having the Right SUV Insurance

With the right SUV insurance, you get:

- Peace of mind

- Financial security

- Faster repairs

- Stress-free claims

- Better resale value

Good SUV insurance protects both your vehicle and your savings.

Final Thoughts

An SUV is built for strength, safety, and adventure. But without proper insurance, even the strongest SUV can become a financial burden. Choosing the right SUV insurance is not about saving a few bucks—it’s about protecting a valuable investment.

Take time to compare, understand coverage, and select the right add-ons. With the right SUV insurance, you can enjoy every drive with confidence and peace of mind.

Drive big. Protect smart. Choose the right SUV insurance